Solutions

Dalkia provides a full spectrum of energy efficient technologies and services to commercial and industrial companies nationwide.

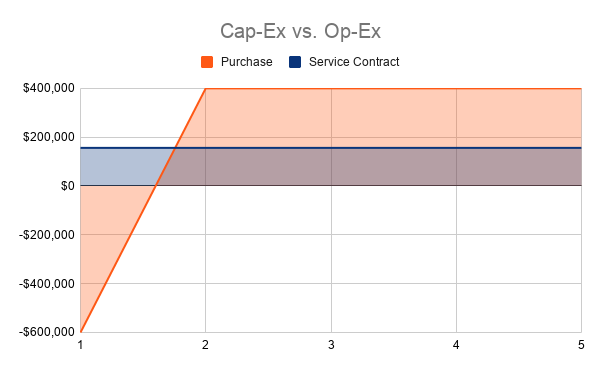

The tension between pursuing efficiency opportunities versus securing the investment capital required has always existed. For over 30 years the traditional ESCO market has offered a performance contracting approach that allows Federal and MUSH industry organizations to finance their building efficiency system upgrades. However, the commercial and industrial market has not had those options.

In the last several years the financing market for energy efficiency has become broader, with an increasing number of techniques that commercial, industrial and institutional organizations can consider to achieve their energy and sustainability goals.

Financing energy efficiency is compelling because it provides a way to achieve cash flow positive savings without a negative operational impact to the building occupants. Whether it’s lease financing, on-bill financing or Energy-as-a-Service, there are many options. Dalkia can employ a multi-tiered strategy when assessing existing building systems to identify incentives, grants and other financing opportunities. Dalkia maximizes the economic performance of building energy upgrades while reducing or eliminating the capital required to get started and keep going.

We understand that time and resources are limited, so we leverage our team of knowledgeable engineers and energy specialists to identify and monetize all available financing opportunities from utilities, clean energy trusts, government-lead grant programs, Federal Energy Policy Act (EPAct) incentives and more.

Through our EDF affiliates and financing partners, Dalkia can own and operate your on-site generation assets to eliminate unnecessary operational burdens or capital allocation requirements.

This financing is delivered in the form of a Power Purchase Agreement (PPA) or lease structure that monetizes all available tax incentives, rebates, Renewable Energy Credits, or alternative revenues that make it easier to reduce energy costs without capital investment.

In some markets, Property Assessed Clean Energy or “PACE” financing allows for the project financing to be collateralized by the real estate rather than corporate credit. This variety of financing can be utilized within a PPA structure to reduce customer credit requirements.

For buildings in deregulated energy markets, your on-site energy and energy efficiency projects can be financed on-bill along with retail energy supply from our affiliate, EDF Energy Services. For more details on our on-bill financing program, see our Retail Energy page here.

If your organization prefers to own these assets, our team can help navigate the complex incentive landscape to identify opportunities to capitalize on financing that is currently available from utilities, clean energy trusts, government-lead grant programs.